|

UR

Finances 101: Frequently asked questions |

||||||

|

What is

the endowment, how is it used

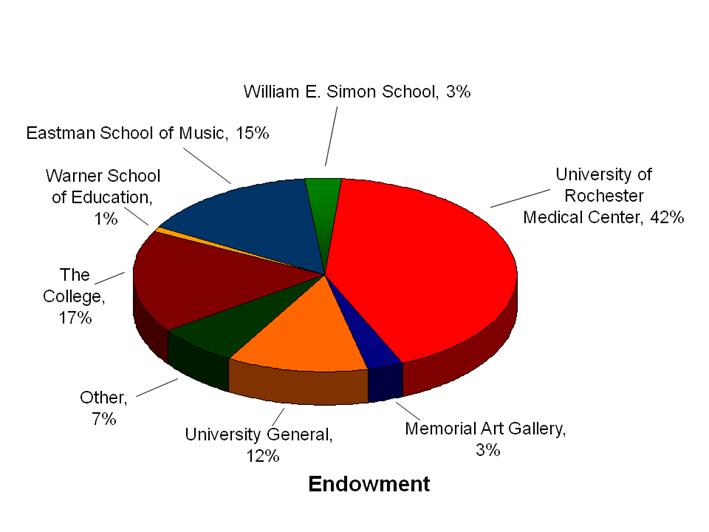

A small portion of the endowment

(12%) is unrestricted, meaning it originated from gifts not directed to a

specific part of the university. In recent years it has been the university's

policy to use most of the income from this portion to support the College.

Smaller portions are used to support the Warner and Simon Schools. How

can we grow the endowment? The growth

of the endowment is affected by three variables: 1.

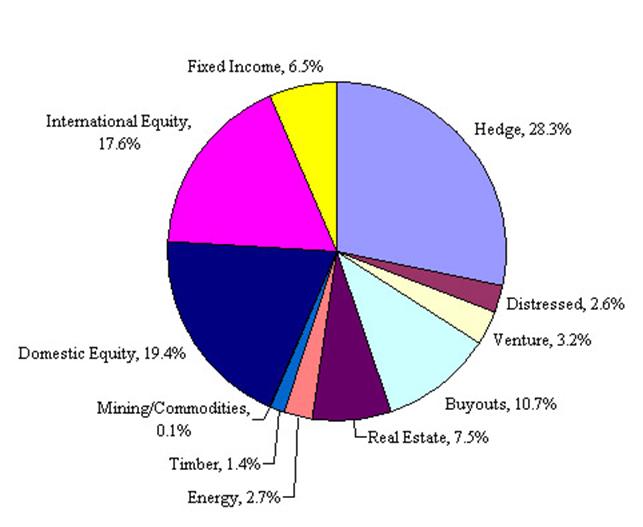

Return on

investment. The university's investment strategy is handled centrally

by the Office of Institutional Resources led by Doug Phillips, with oversight

by the Investment Committee of the University’s Board of Trustees. There is more information about this below. 2.

Gifts to

the endowment. In the long run, gifts matter more than return on

investment. In the 20th

century the university benefitted greatly from major gifts by George Eastman,

Joseph Wilson and others. The growth

of the endowments of peer institutions has likewise been influenced by

sustained gift income. We will discuss

this in more detail on the advancement page. Note that only a portion of gifts received

by the university go to the endowment; some are used to support ongoing

expenses. 3.

The

endowment spending rate. As remarked above, this varies from school to school, and

is the subject of careful attention by the administration of the school, the central administration and the Board

of Trustees.

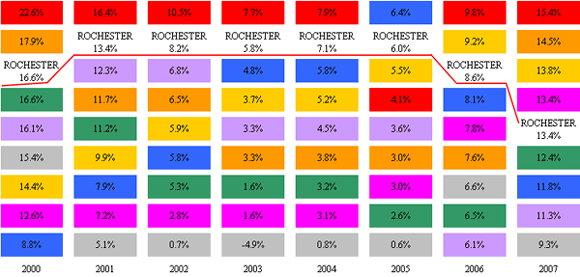

Here is a graph comparing our endowment's performance with

those of various unnamed peers since 2000.

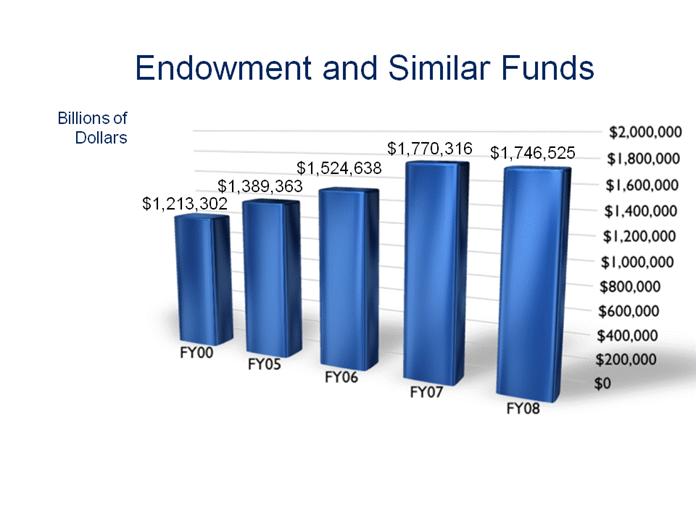

Between

2000 and 2007, our endowment grew by about half a billion dollars from $1.245

to $1.726 billion, but the relative size of our endowment declined from 33rd

to 39th, including a decline from 35th to 39th last year.

This is slide 2 from Joel

Seligman’s January

2008 report to the Faculty Senate. How can the rank of our endowment

by declining despite outperforming many of our peers on the investment

front? The answer is that their

endowments are getting more in gifts than ours is. For more information about this, see the advancement page.

(This is the source of the pie charts and graph shown

above)

|

||||||